OneVest — Helping investors take better control of their funds

In 2021, I embarked on an exciting venture with my team at One Capital to develop a groundbreaking crowdfunding app. This innovative platform aimed to democratize investment opportunities by opening doors to the general public. Unlike traditional investment platforms, our app was meticulously curated by seasoned investment analysts, ensuring that every project and company featured met rigorous standards.

- MY ROLE

Lead Product Designer

Starting with the business opportunity

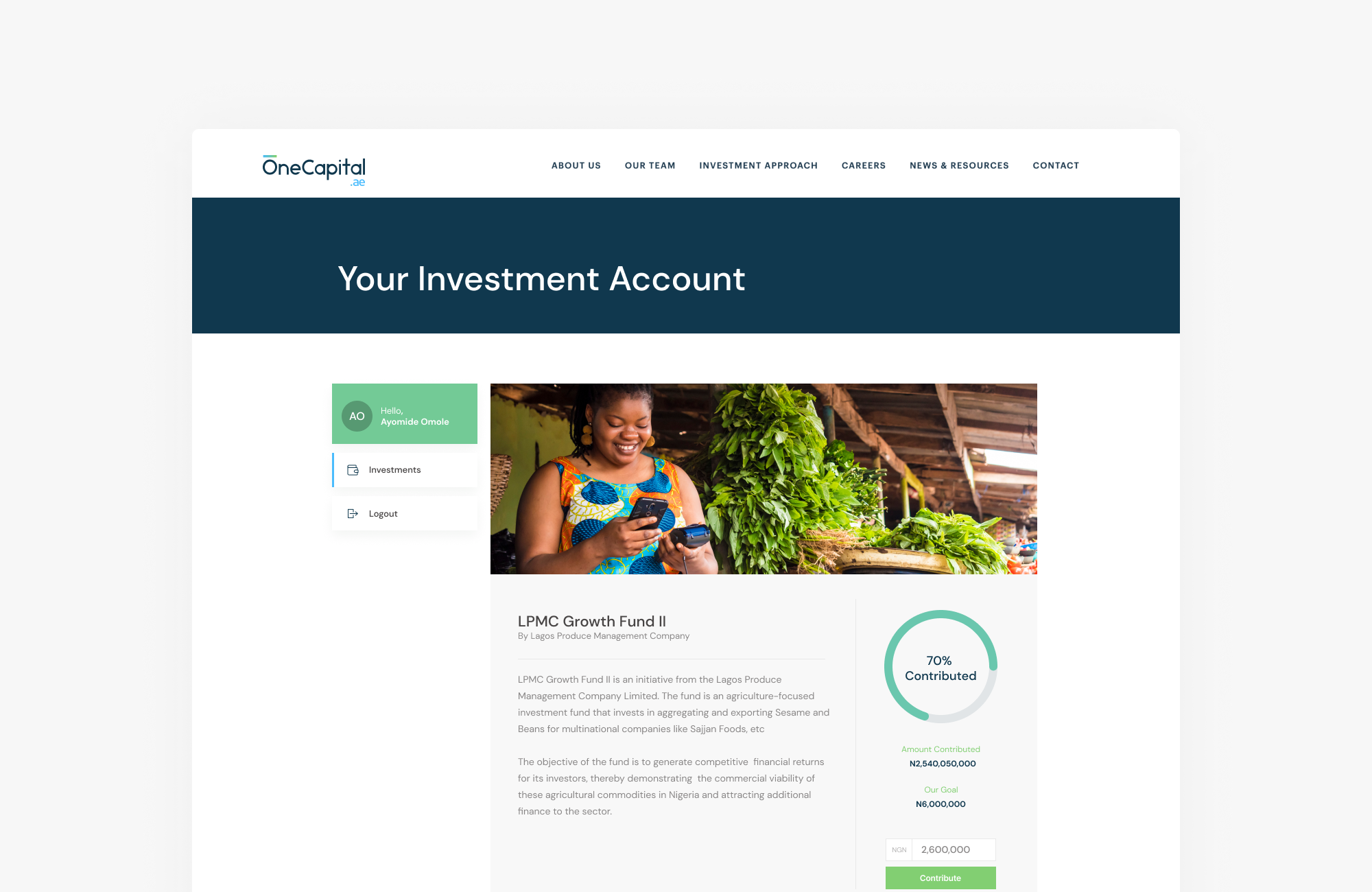

One Capital is largely involved in investing in promising agriculture ventures. But in 2021, there was a shift internally to investing in other business areas. While most of the ventures of the business are funded internally, there had previously been instances where projects were crowdfunded using a platform internally built by our team.

With the initial platform designed, we were able to raise funds for a number of internal projects and subsidiary companies. In the space of 9 months over $ 20 million was raised with such a simple system.

300 investors were onboarded via an invite-only beta testing phases, with over 10,000 interested users signing up to be on the waitlist.

Some of the major findings recorded were:

1. Nigerians were very interested in investing in viable projects backed by experts and accurate financial data

2. Numerous startups and projects go unfunded, due to poor discoverability and substandard publicity.

One of the projects funded with the MVP project was the 'Agricorp Series-A Funding' which raised 17.5 million dollars

The Challenge

In light of the success of the MVP developed we decided to explore the idea of opening up crowdfunding to a much larger market. With over 3000 startups in Nigeria, we set out to explore the possibility of a platform that makes investing in these startups and the interesting projects they work on.

How might we help investors find available investments and get the most transparent investment experience possible?

the business goals

To kick things off, we set out to better understand the goals of the business, through a series of meetings and workshops geared towards aligning the business, product and development teams on what the success metrics would look like. We came up with 3 success metrics:

🎯 Onboarding 50,000 users in 3 months, with only 5% customer contact

🚀 CSAT scoring of 80

💰 Investments of $30 million

user research

Our research efforts began with discussing with interviewing some users of the MVP, to get insights on areas of the current platform that was difficult to navigate. Our interviews showed that there were no serious issues using the current platform. We linked this finding to the fact that most of the users of the initial platform were relatively experience investors. Also the platform was quite basic.

To help understand what pains and needs come with being a new investor, we set up interviews with 20 participant who fit into this criteria:

→ Never invested before

→ Limited knowledge of financial markets

→ Aged 20 - 60

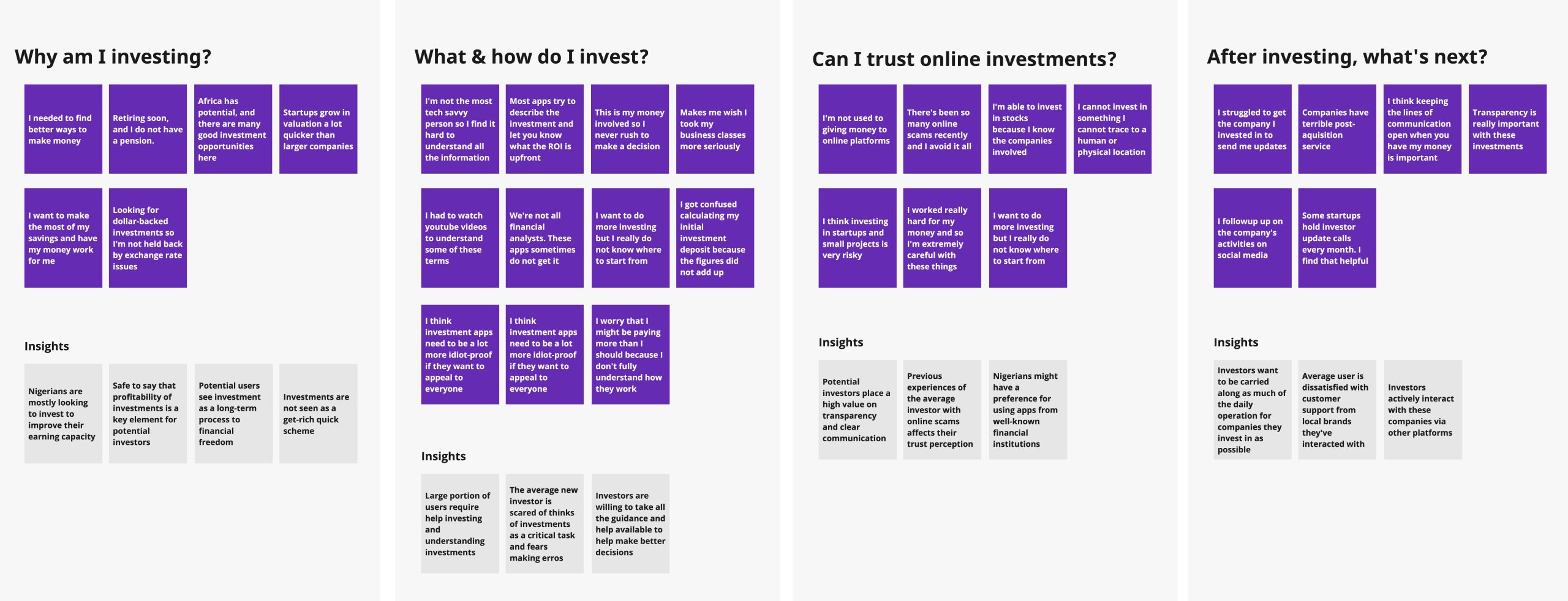

To help make sense of the information we gathered, we analysed the responses base on themes which turned out to be 4 questions an average new investor asks:

OUR FINDINGS

Our research revealed a number of obvious problems with investing as a new or experienced user. We were able to highlight some key, actionable insights to steer us on the right path of what needed to be designed for

1. Users do not care about investments, they care about making money.

2. Limited financial education = Too many uneducated investors

3. There's a huge problem of trust in general, with e-investing

4. Even skilled investors appreciate simplicity of information

5. Most investment companies have terrible post-investment service

6. Nigerians buy into ideas and people, not business names

DEFINING OUR User personas

Based on the interviews conducted with users of the MVP and potential investors, we derived two user personas to guide our thinking. The user interviews also revealed that only 30% of people looking for investment opportunities consider themselves skilled at it. This helped us in deciding on what the primary user group for the investment app was.

USER STORIES

Based on our research we narrowed down our understanding of what user's finds as most important, and came up with three salient user stories to guide our design efforts.

1. As an investor, I want to be able to find viable investments, so I can increase my earning potential

2. As an investor, I want to be able to validate the trustworthiness of the companies or projects I invest in, so I can reduce my risks

3. As an investor, I want to be able to get updates regarding my investments, so I am always aware of what's happening to my funds.

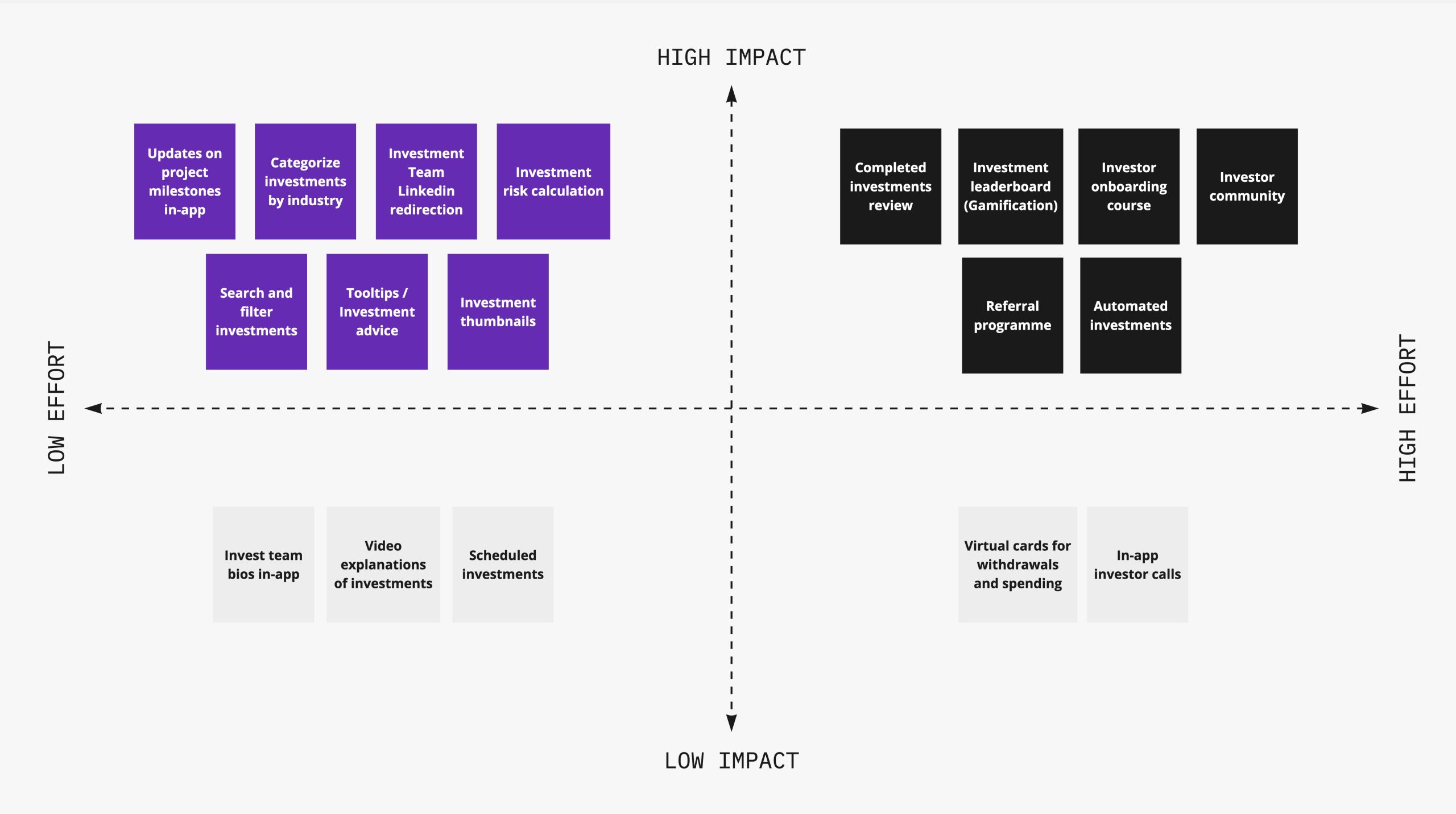

IDEATION & PRIORITIZATION OF FEATURES

Following our research, we brainstormed numerous feature ideas, drawing from diverse sources and our collective creativity. To prioritize these ideas efficiently, we employed the Impact/Effort matrix. It allowed us to categorize features as 'Quick Wins' for high impact and low effort, 'Big Projects' for substantial benefits but higher resource demands, and 'Low-Hanging Fruit' for easily implementable improvements.

This approach streamlined our efforts, ensuring we first addressed high-impact, achievable features while fostering innovation and enhancing overall productivity.

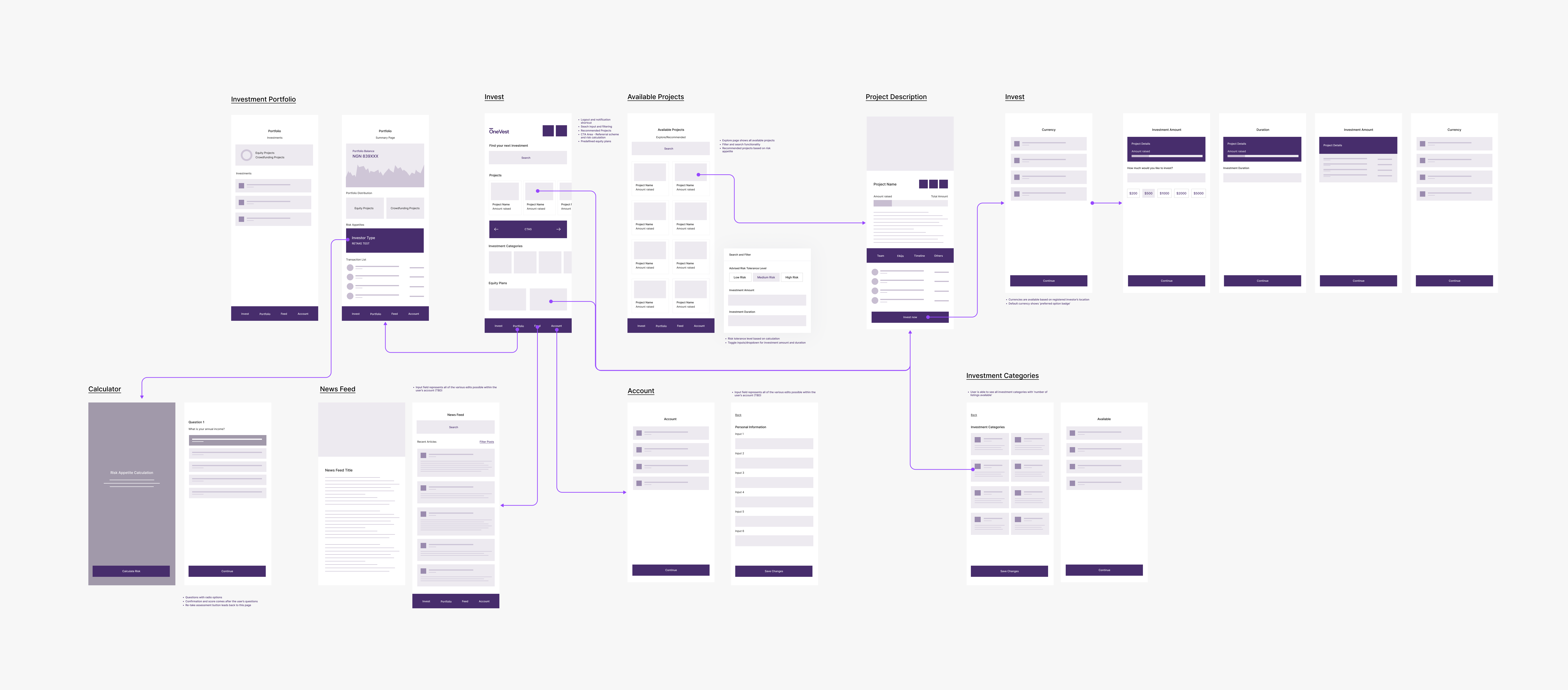

Designing the solution

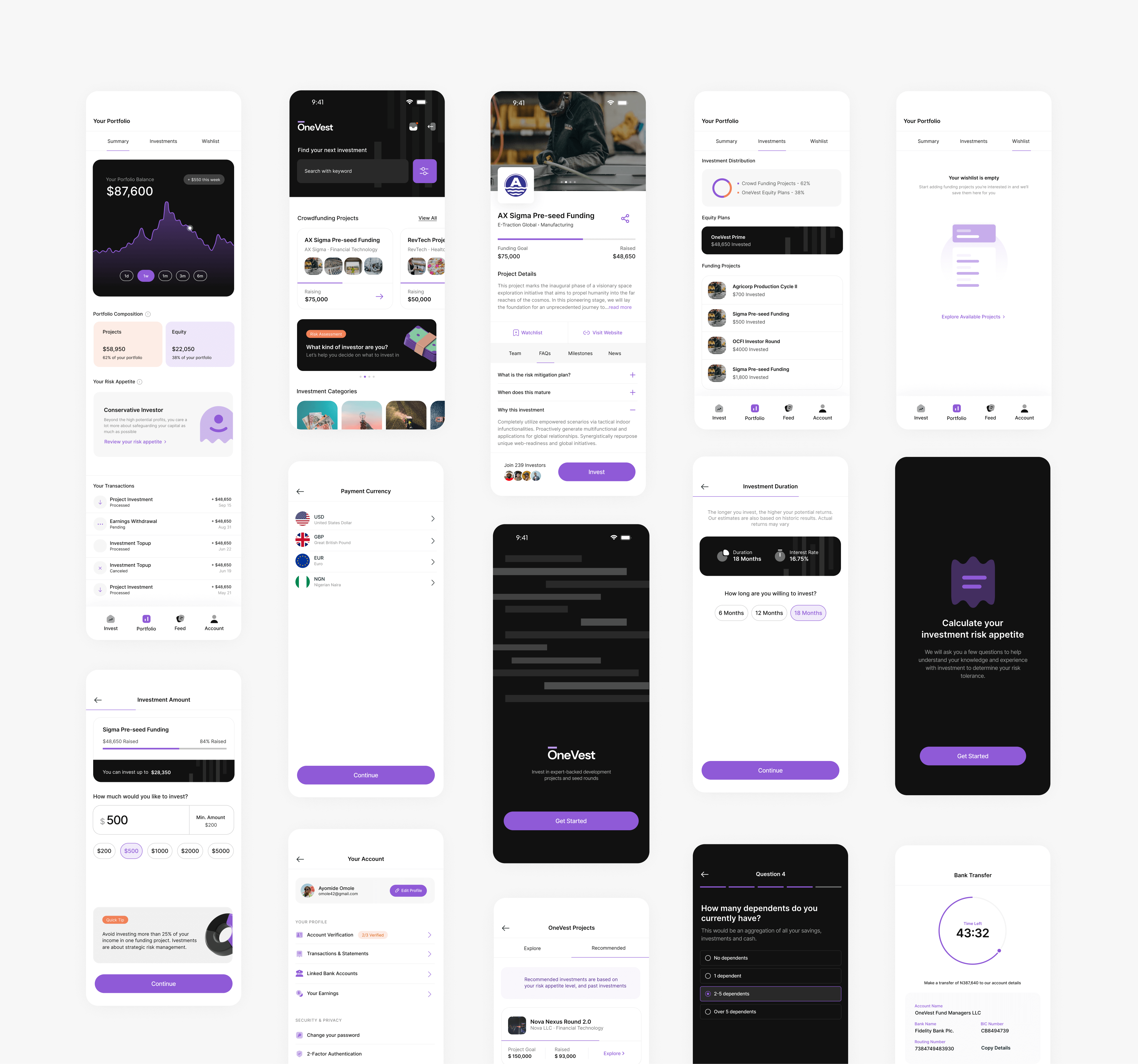

We proceeded to low-fidelity wireframes, providing a solid foundation for our user interface. We iteratively refined the user journey's intuitiveness. From there, we seamlessly transitioned to high-fidelity screens, bringing our vision to life. This approach ensured a comprehensive understanding of the user experience and yielded polished, visually appealing interfaces.

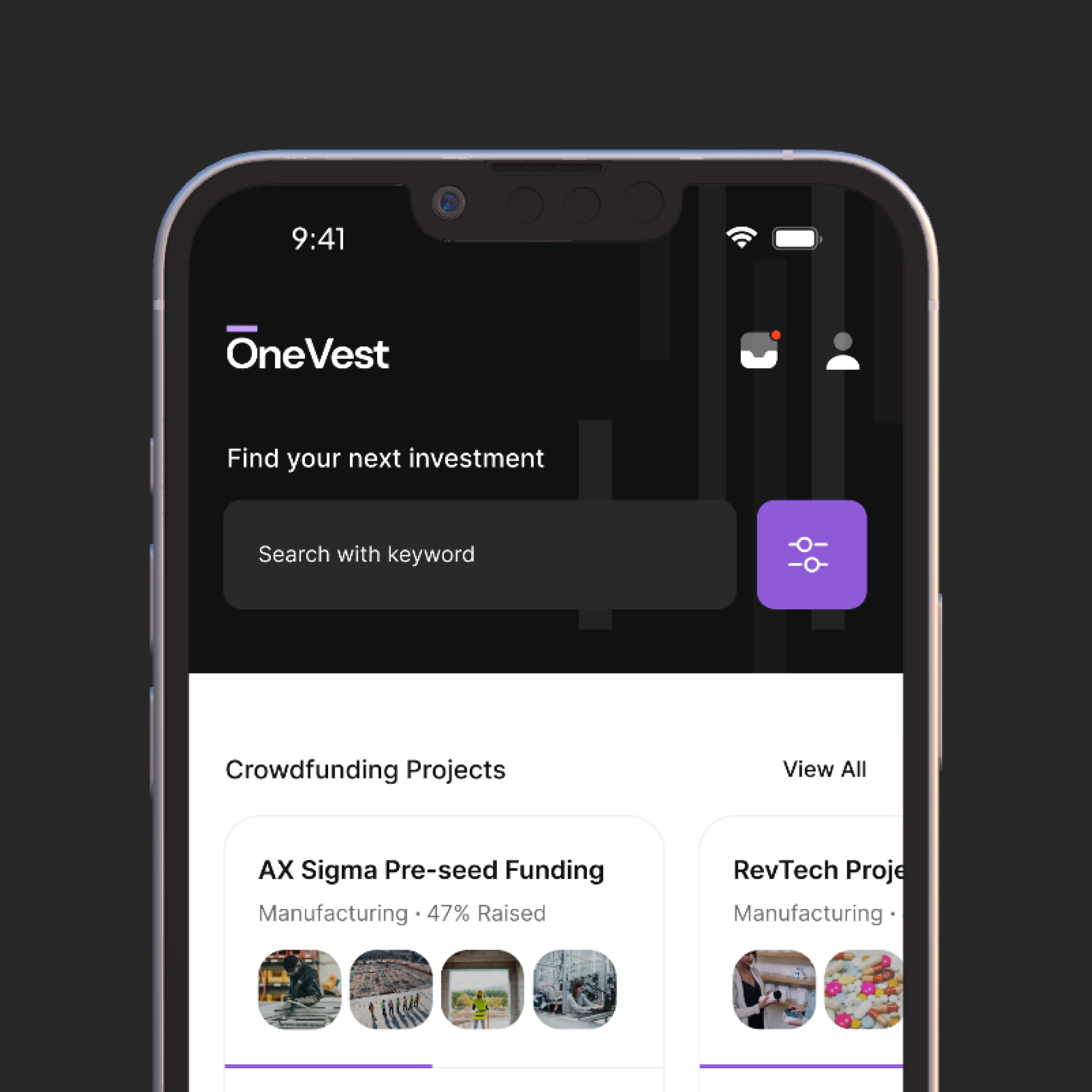

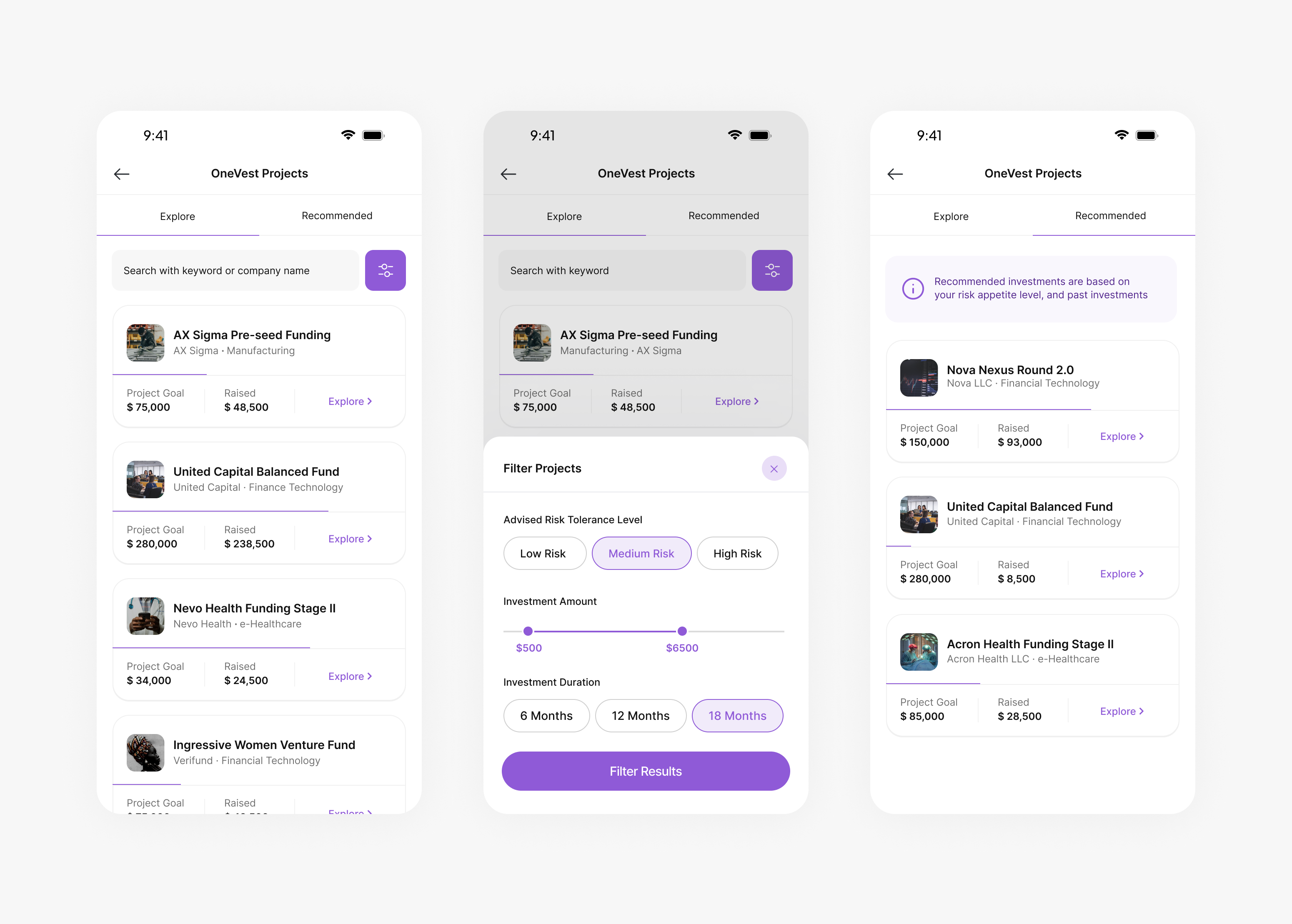

1. Finding investments

Users are able to search and find investments curated by finance experts. For the MVP, they have the option to filter search results based on risk levels, investment duration and minimum deposits.

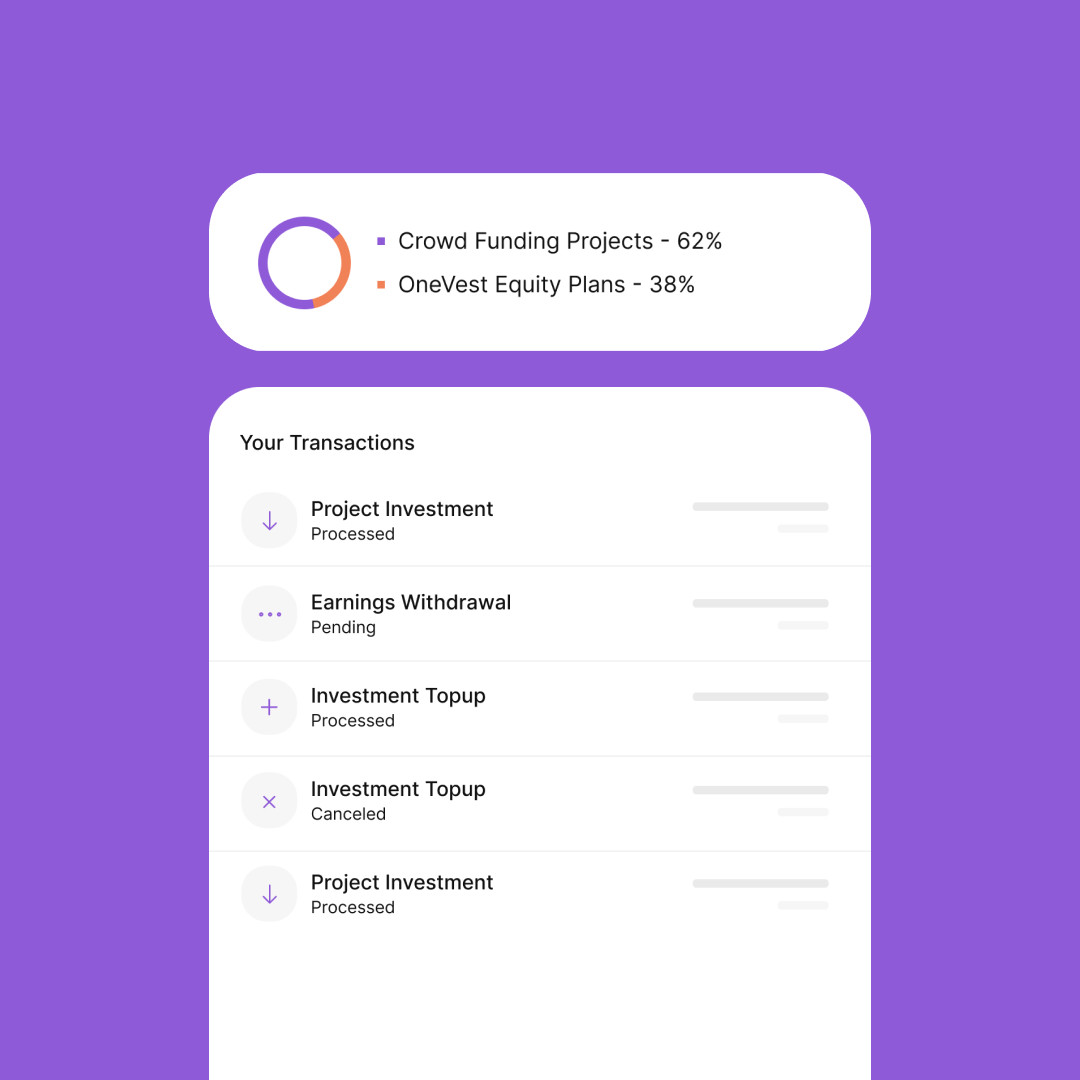

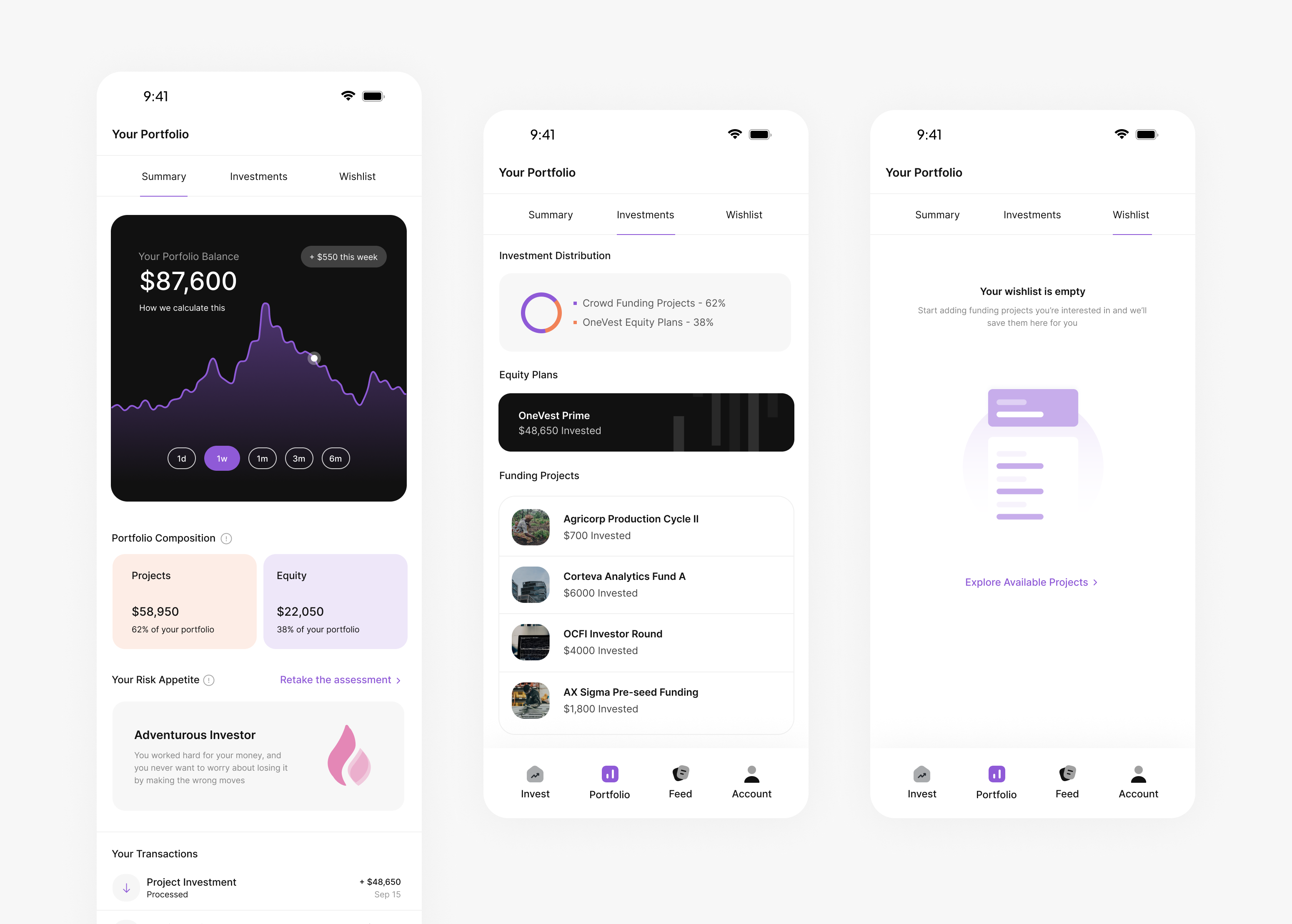

2. portfolio managament

To help users keep an eye on their investments, we designed a simple and intuitive experience to help the average user make sense of where his money is and what he's currently invested in

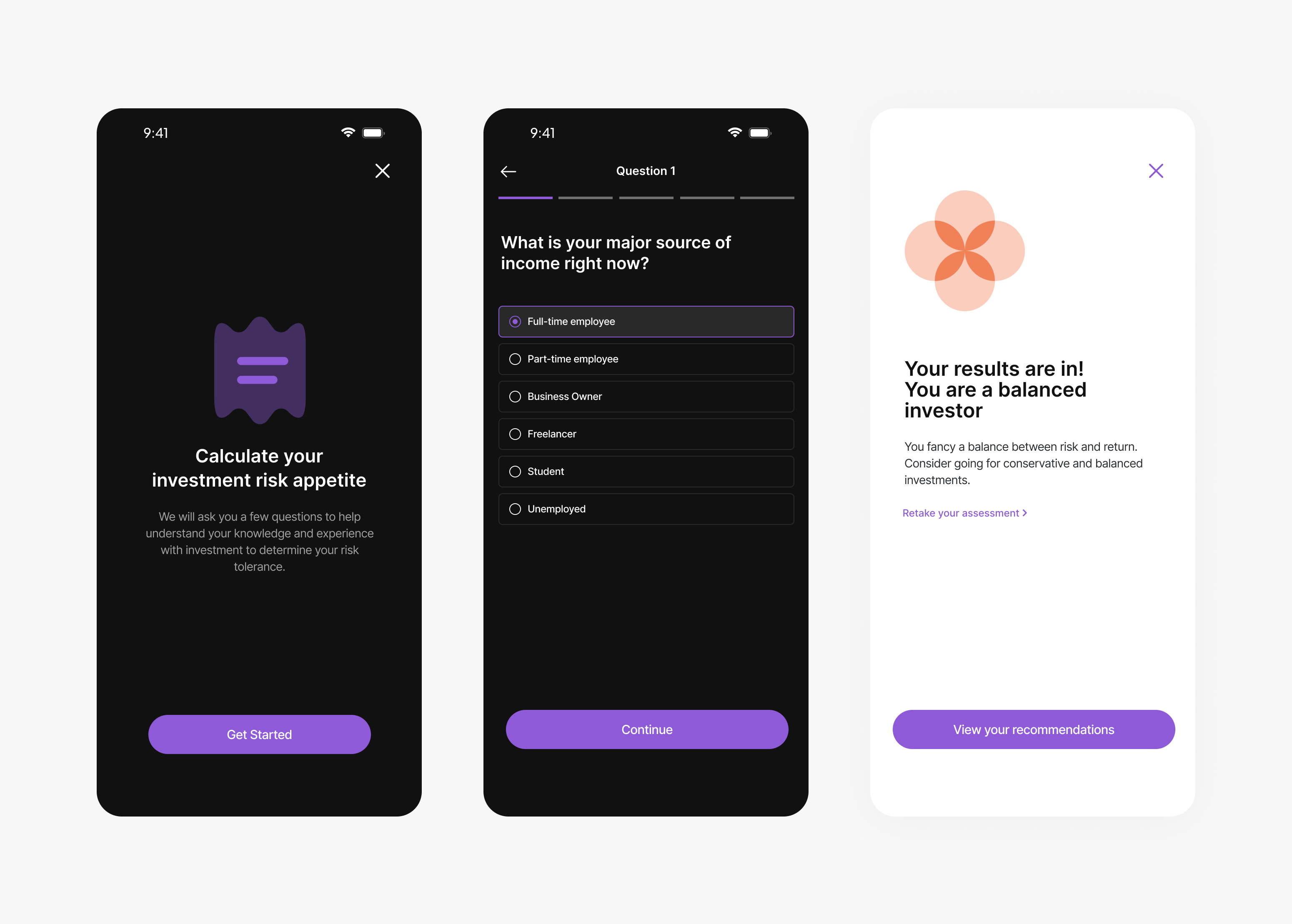

3. risk appetite calculation

To help users make better informed decisions, we introduced the risk appetited calculator based on regulatory standards in Nigeria. We ask five questions to better understand the user's financial status and score based on the user's resonses.

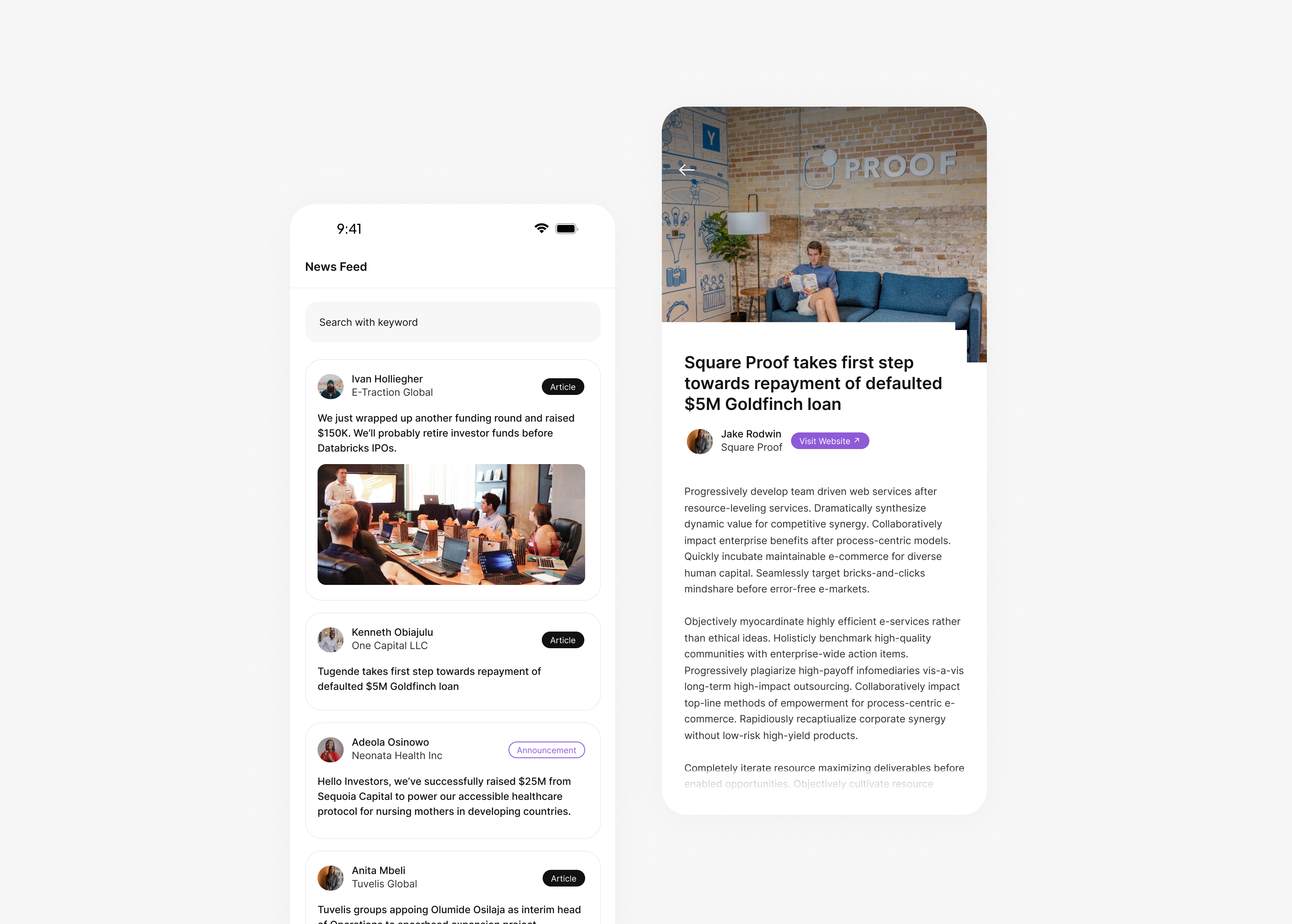

4. news feed

On the news feed, updates from all active projects in the onevest app can be viewed. Project owners have the responsibility of updating all users of the app on milestones, to foster transparency for not just active investors but every user of the onevest platform

Results so far

The onevest project exposed me to a number of new learnings about the Nigerian investment market. It was great to be able to work and design a solution that addresses some of the most common painpoints faced by users. The onevest project MVP is being beta-tested currently. Some of the feedback received already points to the general ease of use of the platform. It was great working with my team on this project.

Special thanks to Uzo Unegbu (Product Manager), Ayo Adeoye (Project Manager), Jide Olutola (UI Engineer), Sylvester Okonkwo (CTO), for making this project a great experience.

Other Projects

- © Ayomide Omole. All Rights Reserved.