Mint Pay — Designing a seamless payment experience for young africans.

In 2023, I worked with a team of experts in product development and design to brainstorm and develop a new experience for receiving payments from overseas as an African.

Our aim was to perfect areas where traditional banking has failed to improve with seamless, intuitive user experience through Mint Pay.

- MY ROLE

Product Designer

THE PROBLEM WITH PAYMENTS IN AFRICA

Even in 2023, Africans still face challenges receiving international payments. MintPay is a solution to long wait times and delays with creating and receiving funds with traditional bank accounts in africa. Many people in Africa don't trust traditional banks because they charge too much, use old technology, and have confusing rules and procedures. It's even hard to get paid from other countries.

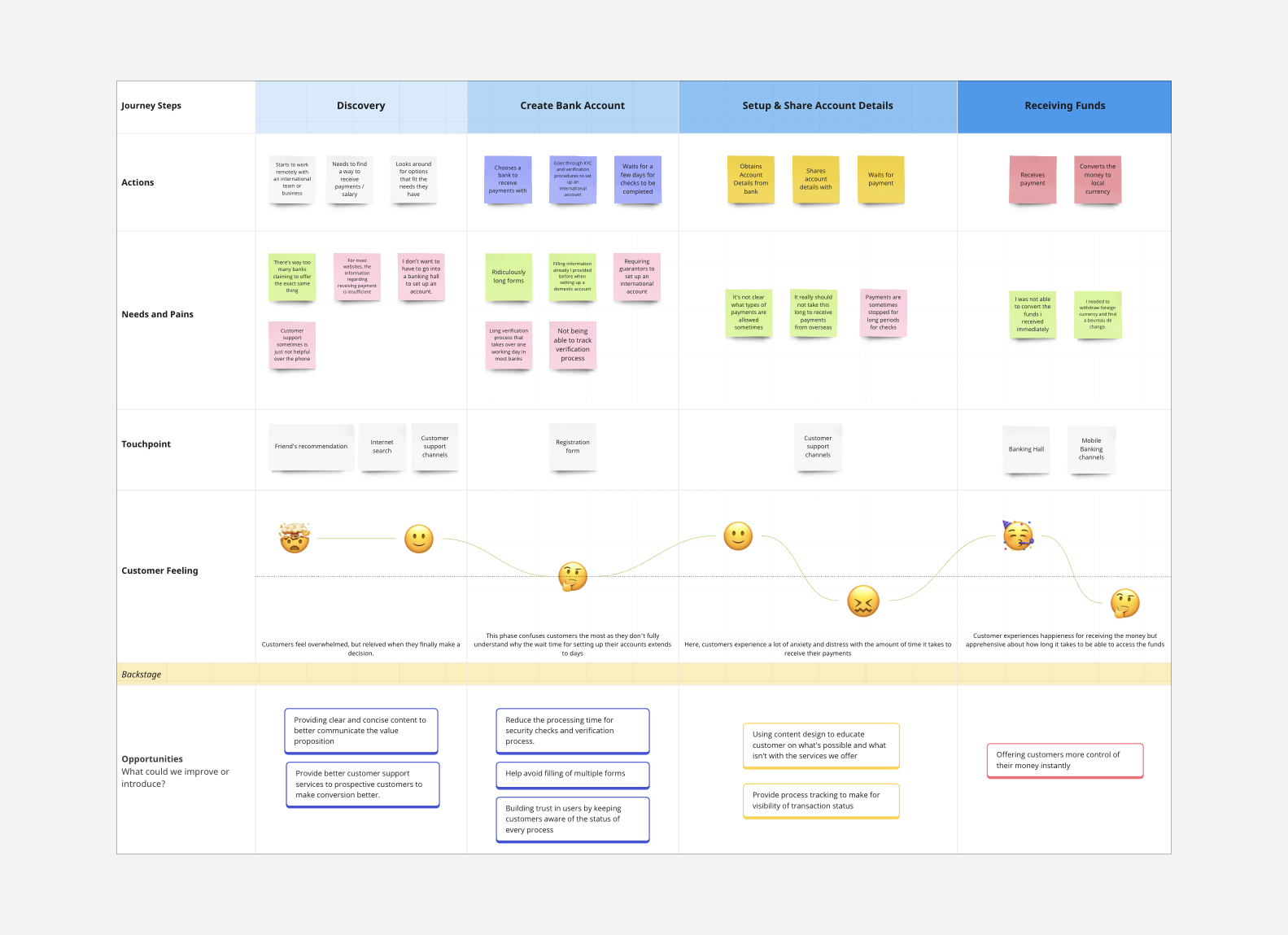

Preliminary research and user-interviews with users of domiciliary accounts in Nigeria and Egypt pointed us to a number of issues with receiving international payments. Based on the responses gotten, we mapped out the currency customer journey when it comes to receiving international payments

We also identified the following problems that needed to be solved to help make receiving payments a lot more seamless.

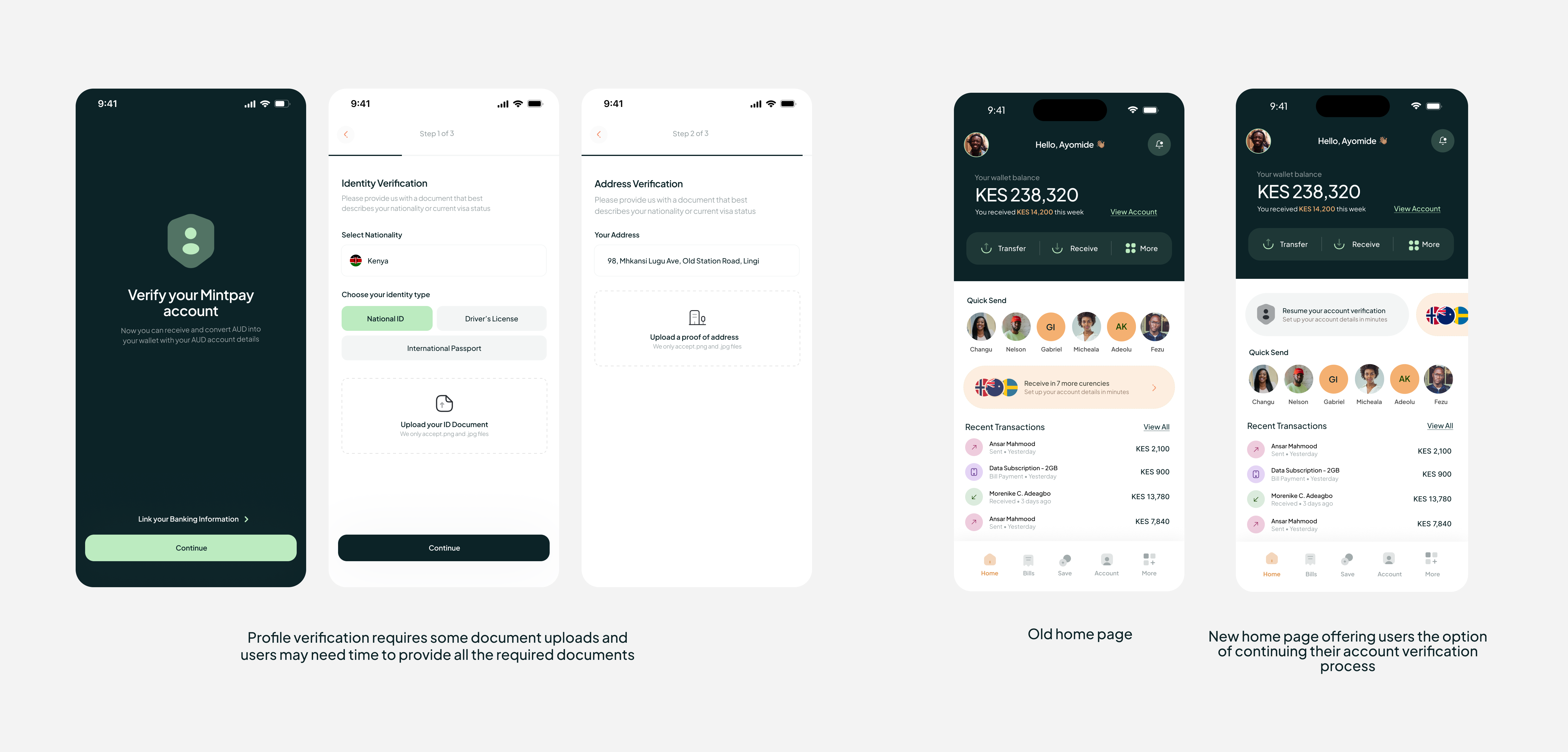

1.  Overly long and often duplicated onboarding processes meant that the average user had to provide the same documents multiple times to set up new accounts

Overly long and often duplicated onboarding processes meant that the average user had to provide the same documents multiple times to set up new accounts

2.  Slow transaction times were highly common. Most users have to wait two days at least to receive an international payment.

Slow transaction times were highly common. Most users have to wait two days at least to receive an international payment.

3. 👤 Substandard customer support is a thing in Africa. Companies usually have very little oversight over this issue and it makes it hard to improve

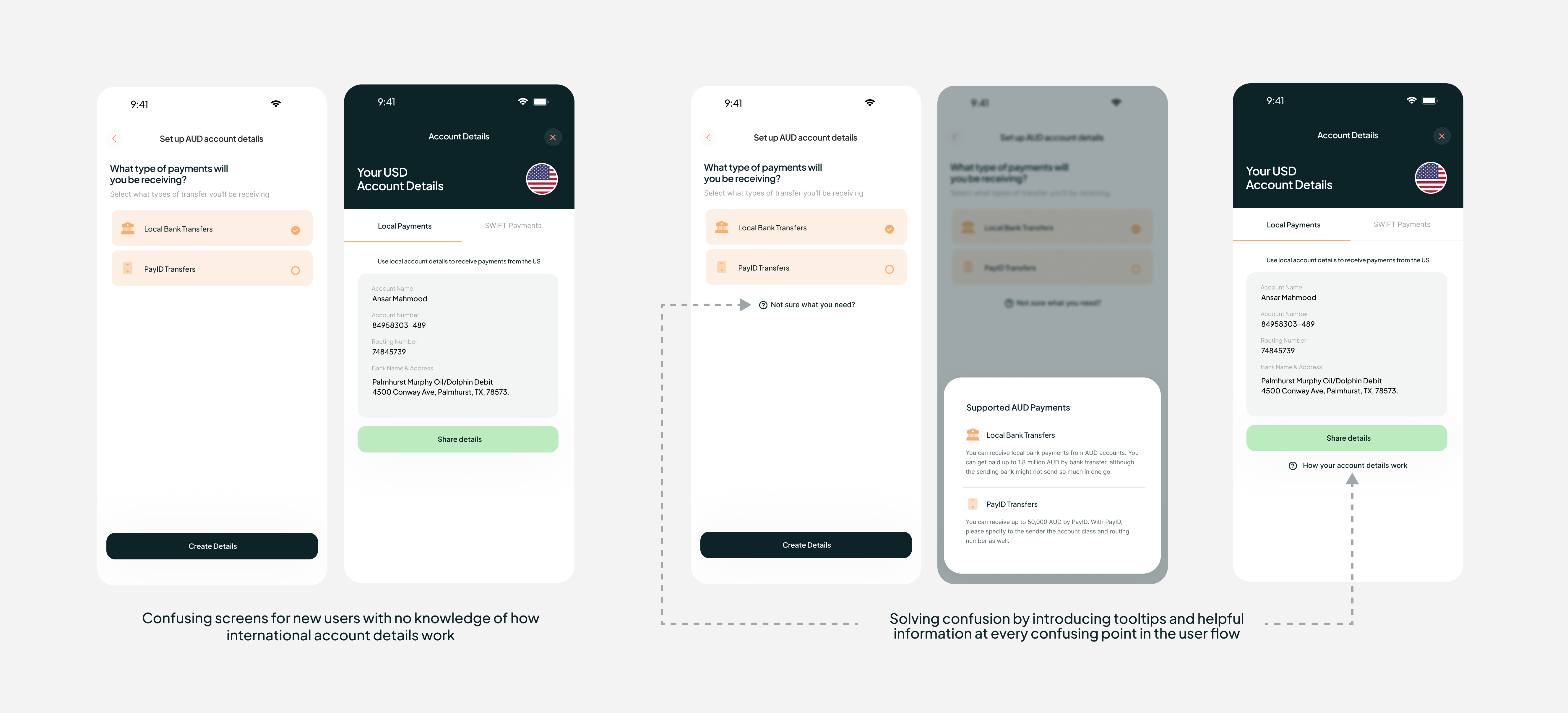

4. 📍 Users want to be aware. The banking industry is quite rigid and lacks transparency, but users want to know what's going on with their money at every point.

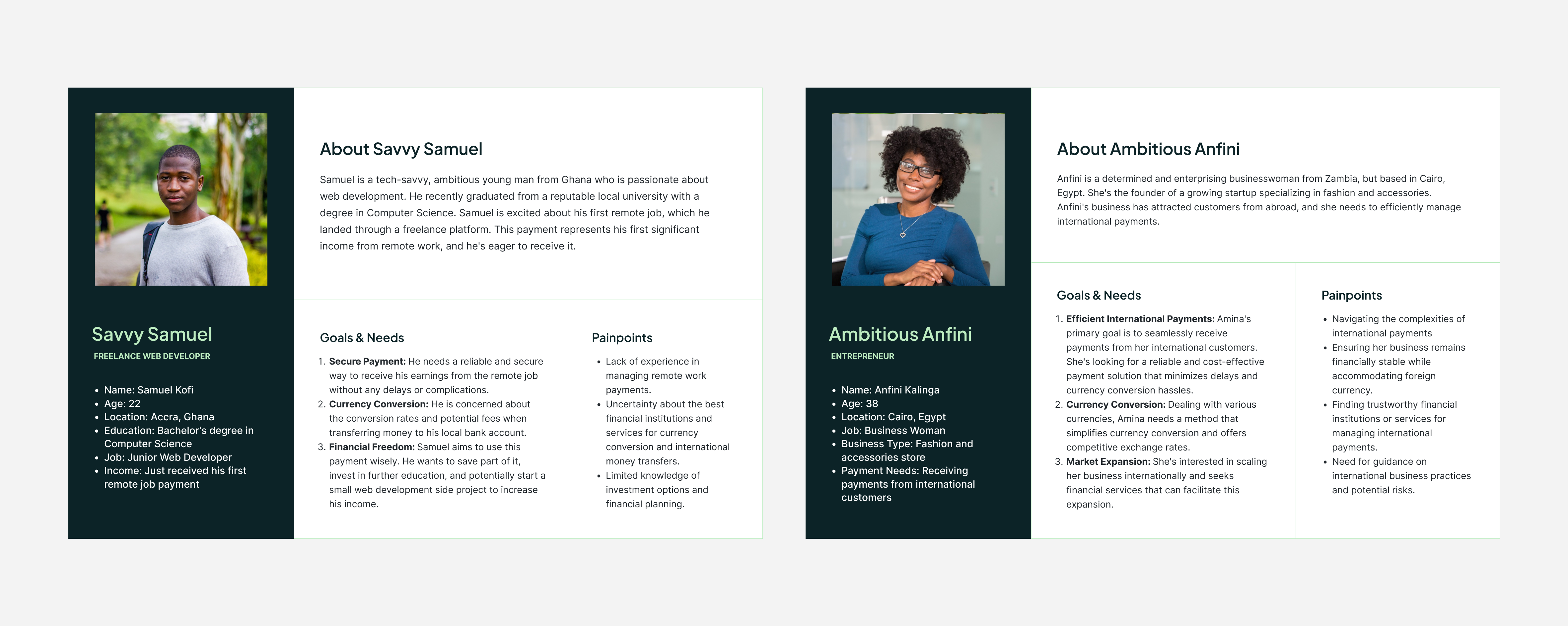

The AFFECTED USER GROUPS

The amalgamation of insights from interviews and journey mapping not only illuminated the specific needs of the users but also paved the way for crafting solutions that resonated deeply with their desires and challenges.

We ended up with two personas to help with our ideation. Both personas are similar, but separated by how they generally perceive and interact with financial services, and what their ultimate goals are. By placing the user's voice at the forefront, we ensured that every subsequent decision and feature enhancement was a direct response to their desires, ultimately culminating in an experience that truly resonated with our users.

DEFINING A SOLUTION

Our research and ideation process got us to a point where we had identified some key elements necessary for a seamless payment experience for our target users.

1. Quicker onboarding: Most users first sign up for an international account out of necessity. Onboarding and KYC needs to be as quick as possible to make it possible for users to get and share their new account details.

2. Seamless and transparent transaction processing: Users want to be able to tell what's going at every point, and what the status of their payment is.

3. Error prevention and rectification: helping customers fix problems and errors as quickly as possible either automatically or with quick and reliable customer support

4. Improving the user's financial capability: providing users with whatever solutions they're already accustomed to that helps them be more financially capable.

IMPLEMENTATION

Implementing our idea resulted in a money app that has the following as key features for the minimum viable product

1. Account details - available for 8 currencies for a start

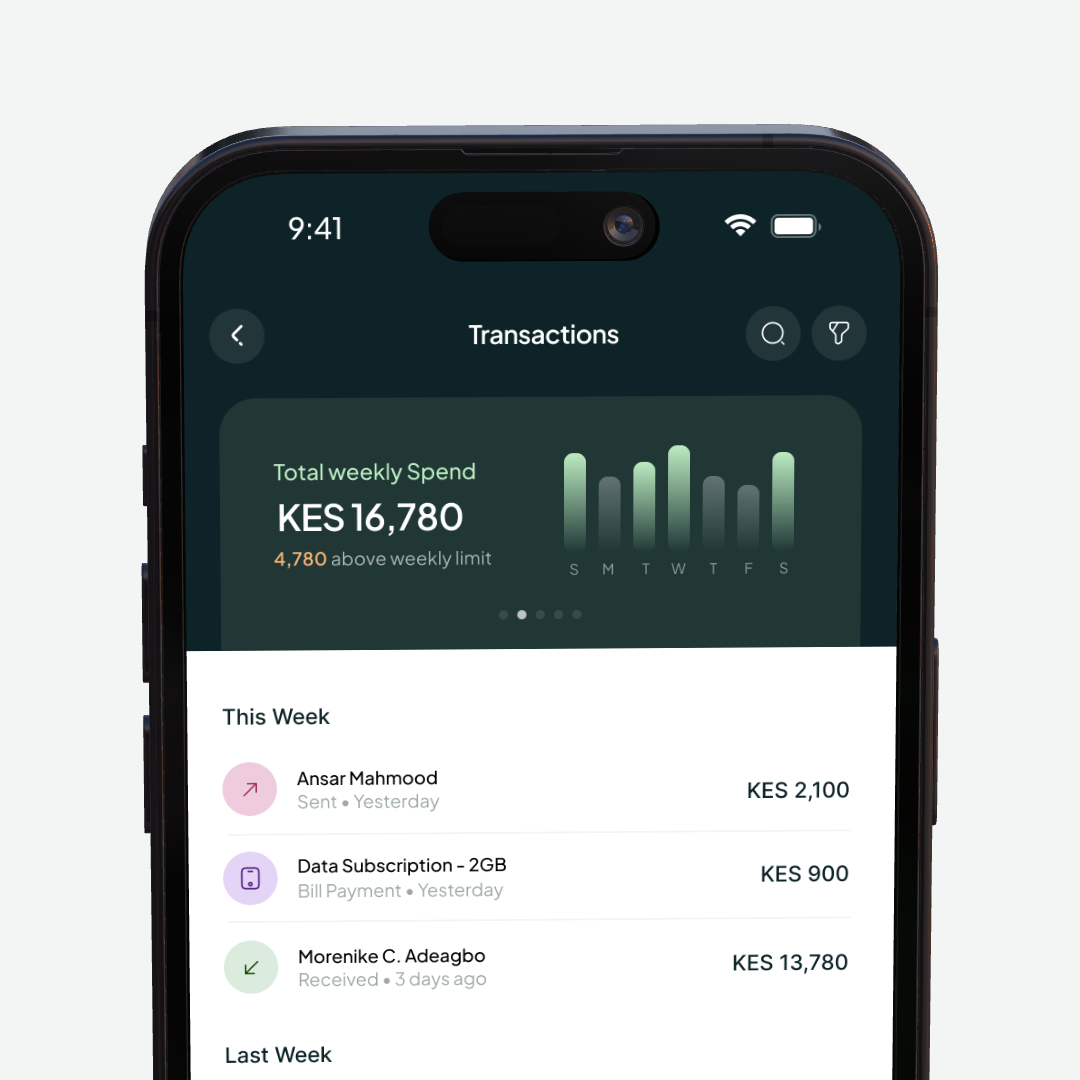

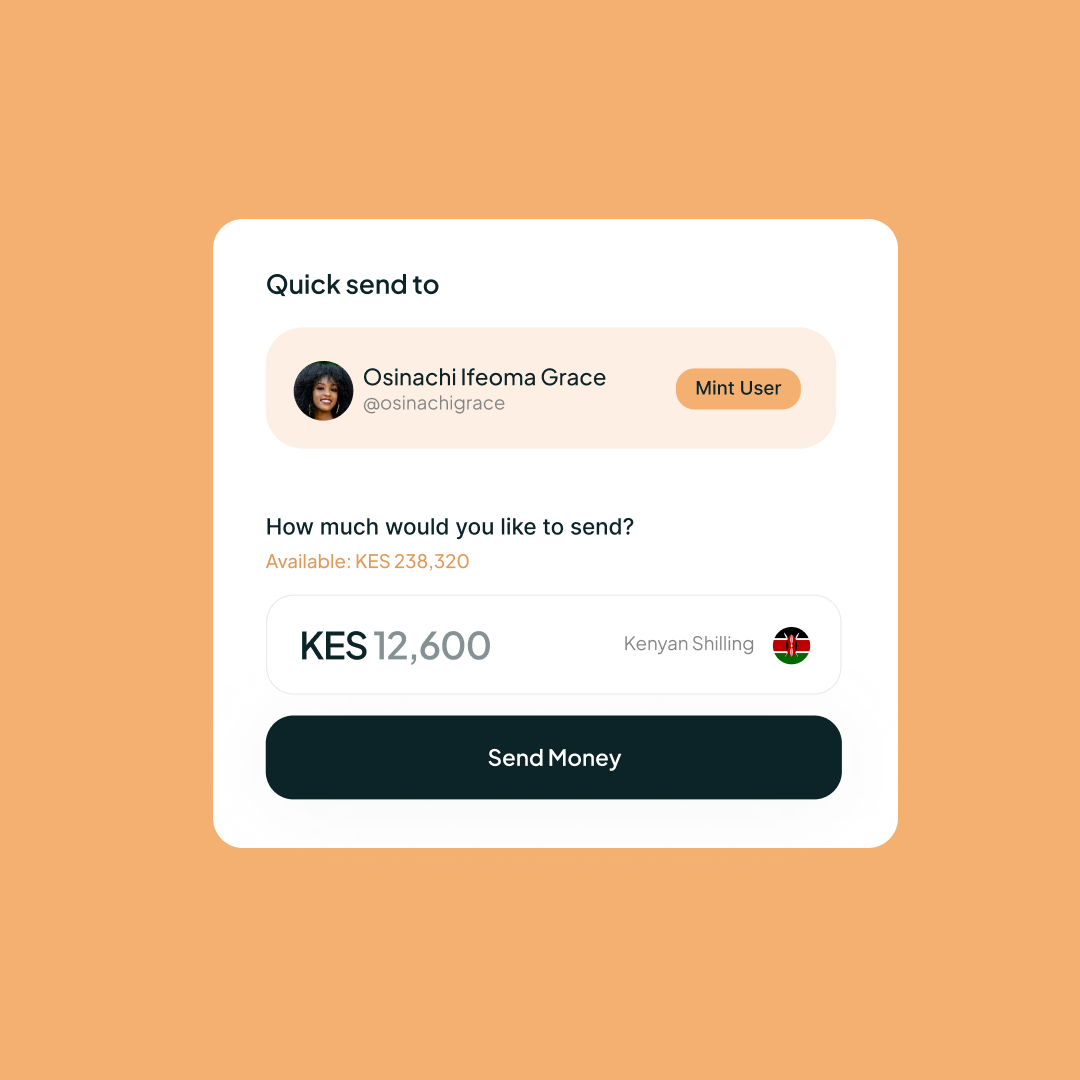

2. Transfers with tracking affordances - users are able to not just get paid, but also make payments and track the transfers (available for international payments)

3. Bill payments - users can pay for electricity, insurance, internet and cable bills from funds received

4. Savings - users are able to save money received and also earn some interest

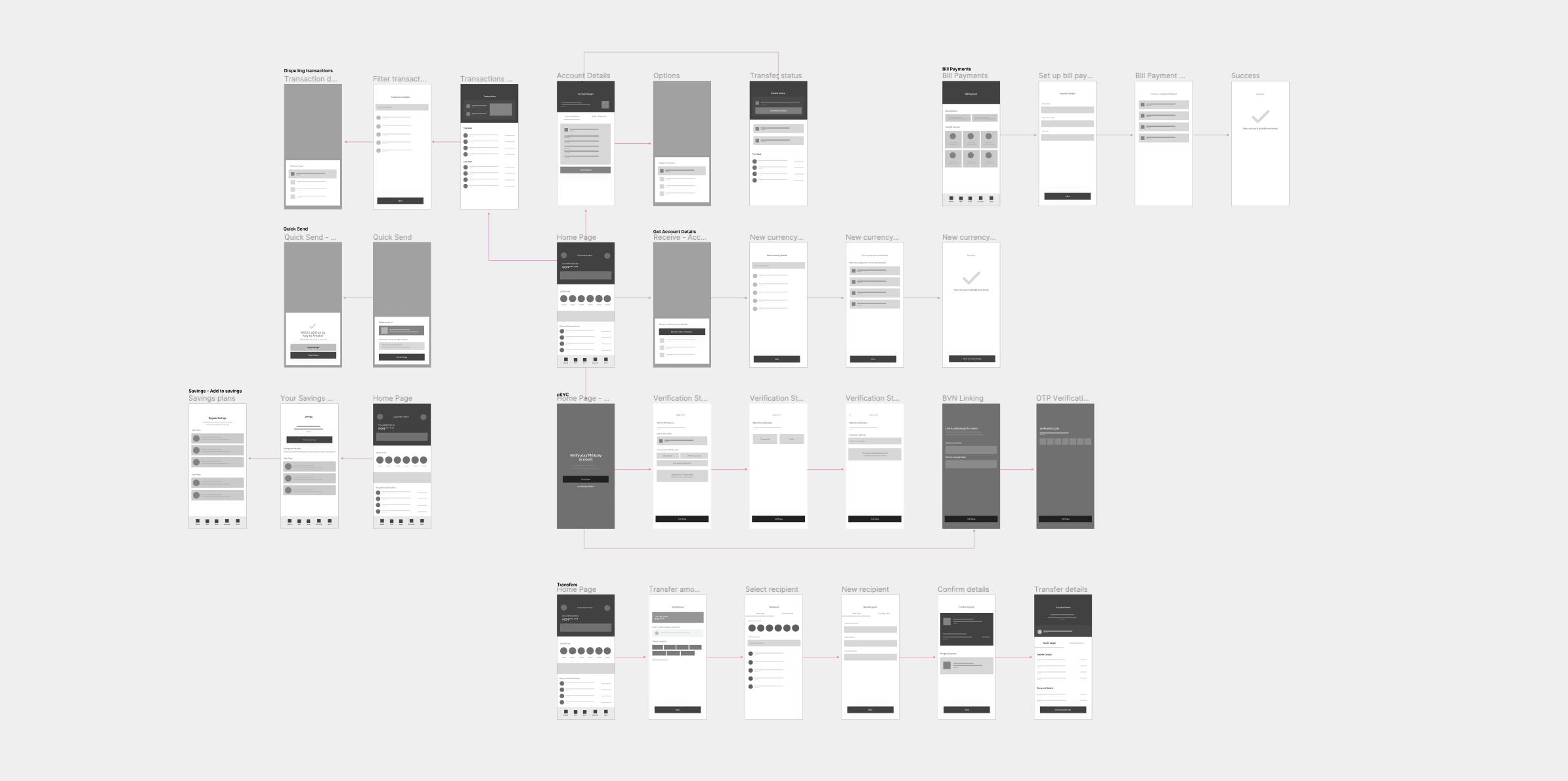

user flow mapping

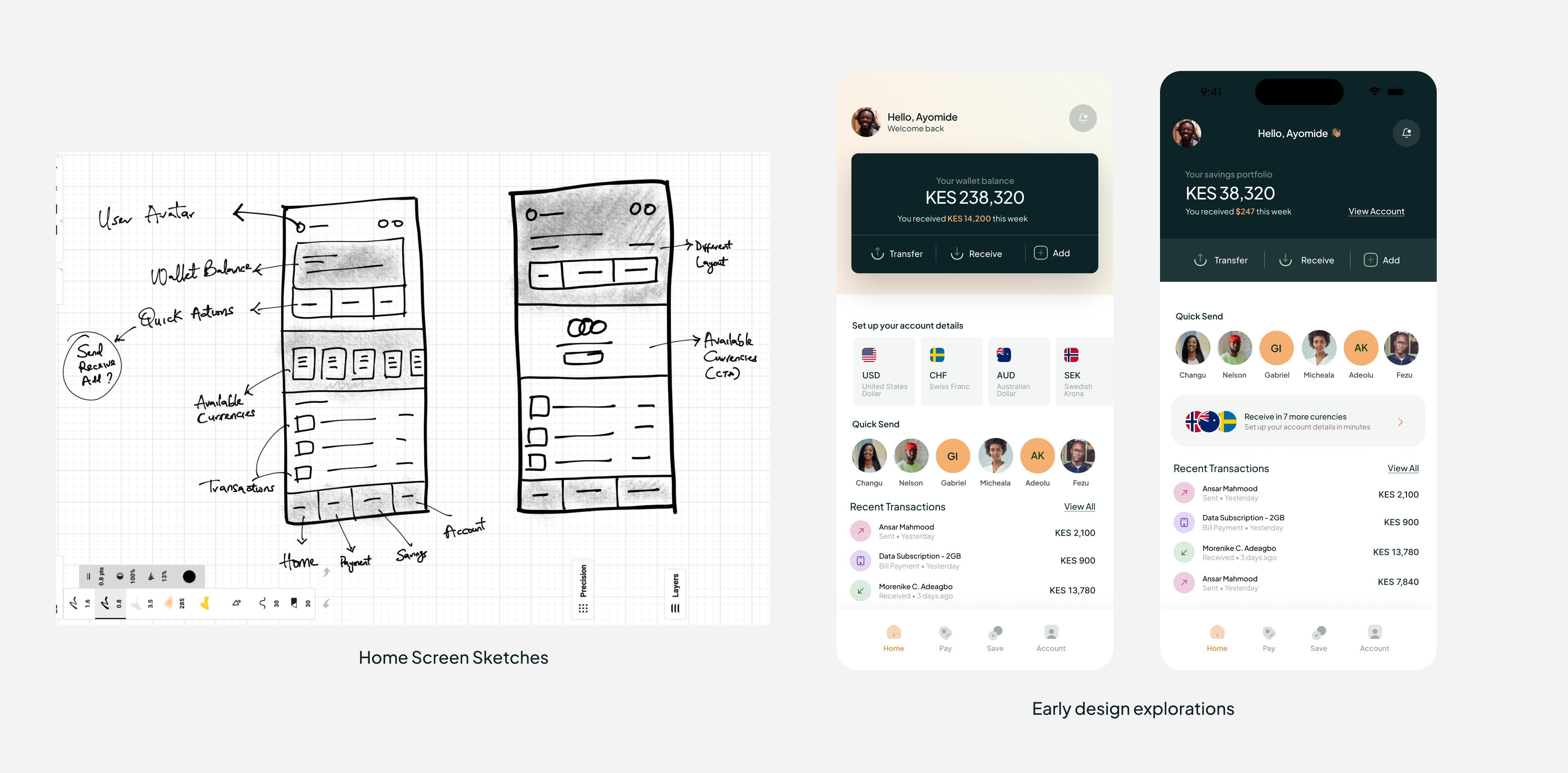

Also worked on wireframes in the early stages of the design process. This process facilitated effective collaboration among the team and provided a solid visual reference for development and design iterations.

HIGH-FIDELITY DESIGn

With high-fidelity prototyping, we brought the envisioned user experience to life with intricate detail. Through interactive prototypes, I showcased the full range of functionalities, animations, and transitions, enabling stakeholders to experience the final product before development.

PROTOTYPING & testing

In the first phase of user testing, we invited 20 users to participate in a usability workshop. Each user was made to carry out 6 tasks, based on the feature set for the MintPay MVP. Users were then interviewed retrospectively to find out what they think about the experience using the MintPay app. Based on the feedback we received, iterations are currently being made.

testing results

104/120

tasks completed

23

misclicks & errors recorded

FIXING USABILITY ISSUES

From the first phase of usablility tests, two major UX flaws were identified. We meticulously analyzed the feedback, prioritized the identified problems, and applied design solutions to enhance the user experience. This process resulted in a more user-friendly and efficient interface, aligning with our commitment to continuous improvement

REFLECTION

The goal with mintpay is simple — make international payments easier to receive for the average african, irrespective of the strict regulations that currently exist. It has been a pleasure to work with a team of brilliant experts from all around Africa on this project. Currently, we're working on other feature sets, like bill payments and savings, and testing to discover usability problems.

Witnessing our design choices directly address these challenges, with empathy and innovation at the forefront, reinforces the transformative power of empathetic research in shaping impactful user experiences. The mintpay project is still very much in the works, but I'm very hopeful about the results.

Other Projects

- © Ayomide Omole. All Rights Reserved.